Skagit County is development-ready.

Utilities

The SWIFT Center is served by a full suite of utility services. These include:

- Water served by Skagit PUD

- Wastewater served by the City of Sedro-Woolley

- Electricity served by Puget Sound Energy (PSE). The SWIFT Center can be provided with up to 6MW of electricity through a PSE substation south of the Campus.

- Further power support for the SWIFT Center is served by BPA transmission infrastructure adjacent to the SWIFT Center, through 230KV lines, 500KV lines, and a large BPA substation south of the Campus.

- Natural gas served by Cascade Natural Gas; the Williams NW pipeline runs through the western portion of the SWIFT Center property

Zoning and site constraints

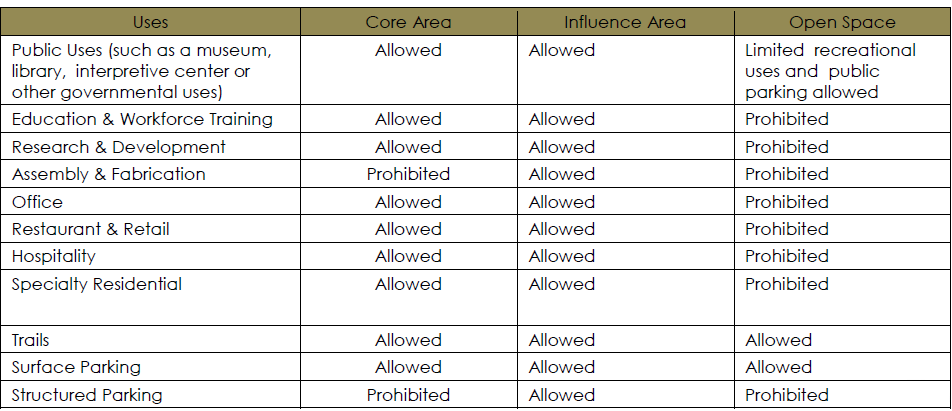

The Sub-Area Plan at the SWIFT Center establishes a set of goals and policies along with a land use plan that promotes redevelopment and respects the character of the historic district.

The land use plan organizes and directs future uses to three defined development spaces called the “Core,” “New Construction” and the “Open Space” Areas. The land use plan is a major mitigating measure, directing appropriate uses to specific areas within the Center.

- The Core: The Core Area includes the historic central section of the Center, where the primary functions of the Northern State Hospital once existed, and includes the Administration Building, Hub Building, and Wards.

- New Construction: Areas include the support facilities of the former hospital (the Powerhouse, Maintenance Buildings, and shops) and the largely undeveloped property south of Thompson Drive.

- The surrounding Open Space area is intended to preserve natural systems and open spaces while providing a buffer between adjacent land uses. Infrastructure and parking is also allowed within this area.

Keeping SWIFT a historic district

If a property is listed in the National Register, certain provisions of the Tax Reform Act of 1976 as amended by the Revenue Act of 1978 and the Tax Treatment Extension Act of 1980 may apply. These provisions encourage the preservation of depreciable historic structures by allowing favorable tax treatments for rehabilitation, and discourage destruction of historic buildings by eliminating certain otherwise available Federal tax provisions both for demolition of historic structures and for new construction on the site of demolished historic buildings.

Owners of historic buildings may benefit from the investment tax credit provisions of the Revenue Act of 1978. The Economic Recovery Tax Act of 1981 generally replaces the rehabilitation tax incentives under these laws beginning January 1, 1982 with a 25 percent investment tax credit for rehabilitations of historic commercial, industrial and residential buildings. This can be combined with a 15-year cost recovery period for the adjusted basis of the historic building. Historic buildings with certified rehabilitations receive additional tax savings by their exemption from any requirement to reduce the basis of the building by the amount of the credit.

Learn more about the complete design guidelines for the SWIFT Center.